AI powering secure and intelligent banking and insurance services

AI is reshaping how financial institutions and insurers operate. From risk assessment and compliance to customer experience and automation. BigHub helps leading banks and insurers design and implement AI solutions that are secure, compliant, and deliver measurable business value.

Key challenges of the industry

The financial and insurance sectors face growing pressure to innovate while maintaining strict regulatory compliance and data security. Below are the most common challenges AI can help solve.

Inefficient liquidity management

Limited automation in liquidity forecasting and fund allocation leads to suboptimal capital utilization and increased risk exposure.

Legacy and fragmented systems

Outdated infrastructure and siloed data prevent financial institutions from gaining a unified customer and risk view.

Rising regulatory complexity

Strict frameworks such as EU AI Act, GDPR, and PSD2 demand continuous monitoring and explainable AI governance.

High operational costs

Manual document processing, claims handling, and reporting create heavy workloads and slow execution.

Fraud and risk management

Traditional rule-based models struggle to detect new fraud patterns and emerging risk signals in real time.

Poor data utilization

Vast amounts of unused transactional and behavioral data limit predictive insights and decision-making.

Compliance burden

Regulators require transparent reporting and auditability from all documents — a major challenge for teams using multiple systems.

Slow innovation cycles

Legacy systems and complex approval processes delay AI adoption and experimentation within large organizations.

AI use cases for the industry

AI is already delivering measurable results in finance and insurance - from automating operations to personalizing client experiences.

AI document assistant

Automates claims, credit scoring, and policy document processing with secure large-language-model-based understanding.

Customer intelligence platform

Connects data across CRM, core banking, and digital channels to personalize offers and customer journeys.

Conversational AI for clients

Delivers 24/7 multilingual customer support and guidance through secure chat and voice channels.

AI Liquidity Optimizer

Automates liquidity forecasting and cash flow management using real-time data from multiple financial systems.

Fraud detection engine

Analyzes transaction patterns to identify anomalies and prevent fraud in real time.

Predictive risk modeling

Uses machine learning to forecast credit, market, and liquidity risks, improving decision accuracy.

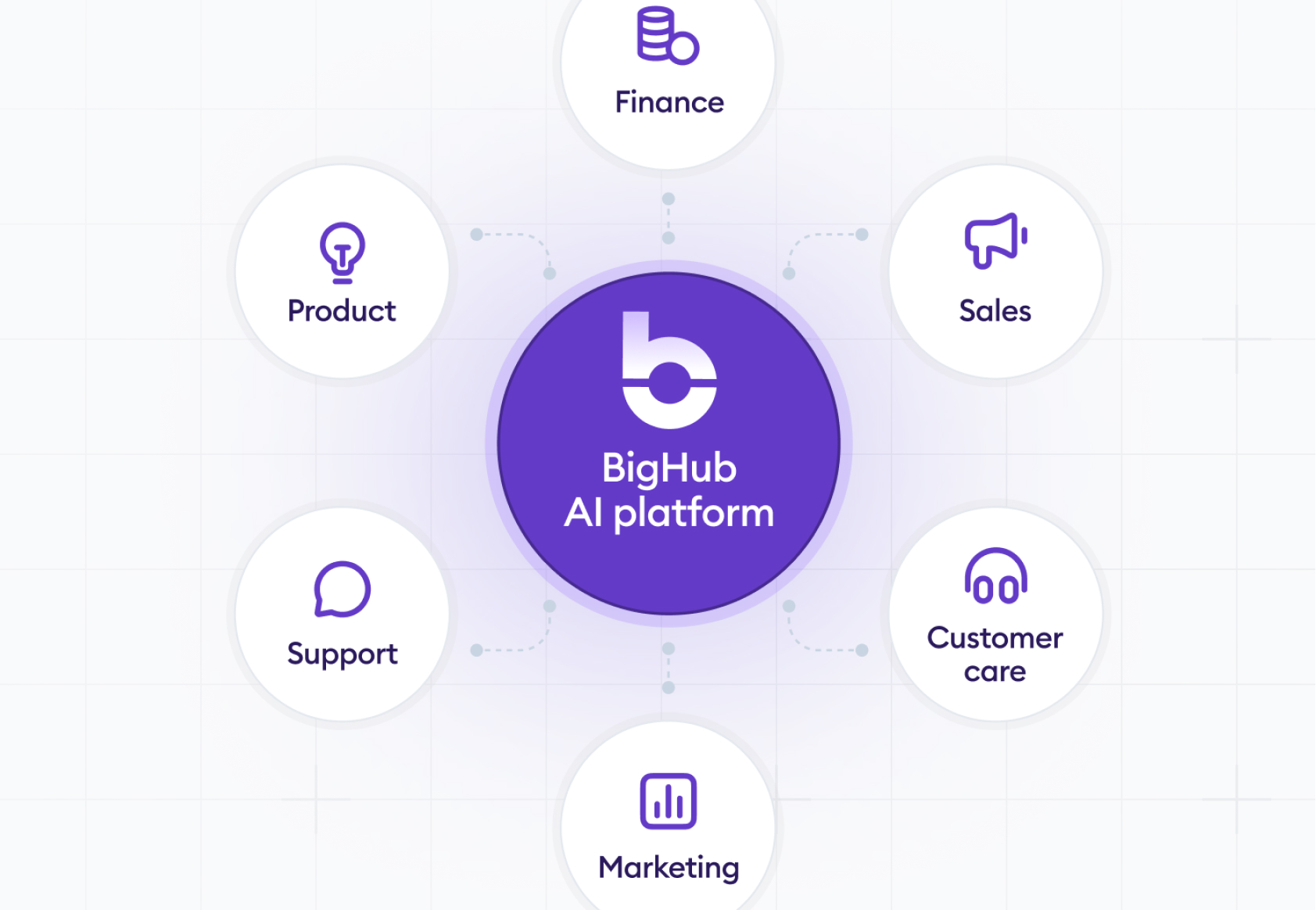

BigHub's solutions for the industry

BigHub delivers end-to-end AI and data solutions from proof of concept to full production.

Case studies from the industry

We help major financial and insurance institutions modernize their operations, enhance data governance, and deploy AI that drives measurable value — securely and at scale.

AI assistant PROKOOP, Kooperativa’s sales team cuts down on admin and focuses more on clients

AI agent system cuts document processing from 15 to 2 mins at Direct Pojistovna

From 3 days to 30 minutes: How NN pojistovna accelerated claim processing

AI-powered VR solution makes ČPP presentation skill development 3x faster

Why BigHub

We help enterprises turn AI from experimentation into measurable business results. Our approach combines deep technical expertise with a clear focus on impact, scalability, and long-term value.

Business ROI first

Every project starts with a clear business case. We identify high-return opportunities and design AI solutions that bring measurable impact — not experiments, but outcomes.

Long term partner

We don’t deliver and disappear. BigHub works as your strategic partner, ensuring that AI initiatives stay aligned with your business goals and continue to deliver value over time.

High expertise

Our team combines data engineering, machine learning, and business strategy experience across industries — enabling us to solve complex enterprise challenges end to end.

Security

We design and deploy AI within the strictest security and compliance frameworks. Your data stays protected, your governance transparent, your operations compliant.

Get your first consultation free

Want to discuss the details with us? Fill out the short form below. We’ll get in touch shortly to schedule your free, no-obligation consultation.

.avif)